See the whole Landlord Forum Thread here

The Fine Art of Landlord Protection. Landlord articles and tips to make being a residential landlord a little easier.

Saturday, June 28, 2014

Short on rent by Bob G - Landlord Forum thread

Eviction Ramifications Notice

This is a common belief among tenants in eviction status. Sometimes your delinquent tenant doesn't really grasp the consequences of a full blown eviction. This eviction letter explains the immediate and future drawbacks to the tenant caused by the process of eviction and it's aftermath. The

is Free. You can print one at Free Landlord FormsWednesday, June 25, 2014

Rental Property in Foreclosure - Now What?

The Rental Property is in Foreclosure. The Tenants Know. What is a Landlord or Property Manager to Do?

By John NuzzoleseIn today's turbulent economy with record foreclosures nationwide, more landlords and property managers are sharing a once uncommon experience: Foreclosures. Today, foreclosures are everywhere you look. Many of the properties in trouble happen to be rentals, some under property management contracts. Let's take a look at the situations faced by private landlords and property managers hired as an agent of the owner.

Private Landlords

Picture this: The tenant is home thinking about making his next rent payment early. A knock on the door interrupts his thoughts only to be told by a bank representative that "the house in in foreclosure. Your landlord is not making his payments. You'd better start paying us directly or we will EVICT YOU!" Unfortunately many banks say even worse things to the tenants to scare them. This creates havoc for the landlord who is very likely trying desperately to find a way out of foreclosure.

How do you handle the tenant when he finds out the home he is renting is in foreclosure? If possible, nip the problem in the bud, before the tenant decides this is an opportunity to stop paying rent.

When you buy bread, do you ask the supermarket if they paid their bread bill?

Why then, does the tenant think he is entitled to FREE RENT when the landlord is behind with the bank?

Tell the tenant, "If you are visited by a bank representative, please let me know right away. Don't let them try to scare you with any of their unethical tactics. They should be talking to ME, NOT YOU." The cooperation of your tenant in this situation is golden!

They figure, "if the landlord's not paying the mortgage, why should I pay the rent?"

Property Managers

I've been asked by property managers, what recourse there is against their client in the event an owner of a property falls into foreclosure. There's not a lot you can do besides sue the owner for breach of contract, if in fact they do lose the property, and your contract provides terms prohibiting the owner from losing the property. Most managers know it's probably a dead end and a waste of time to pursue, especially if the owner is also going bankrupt. Also, keep in mind that your management contract may not have been violated until the owner actually loses the property. You still get to collect your management fee as long as your client owns the property. Foreclosures can sometimes take a long time. It's very possible that your management contract could expire before the foreclosure comes to a conclusion."It's Not Over Till It's Over." - Owner's redemption rights

The management contract can forbid the owner from falling into foreclosure, but if he's going to fall behind on his payments, the manager may have to choose between two options:

Private Landlords and Property Managers

The tenants are contractually required to honor the lease and pay the rent for every month they are there. Even if the owner defaults on his mortgage with the bank,

a) he still retains the right to to redeem himself all the way up until after the foreclosure sale itself.

b) he still retains the right to evict the tenants if they fail to pay rent up until the property is transferred in the foreclosure.

As the LPA Lease says,

WITHHOLDING RENT Under no circumstances may any rent be withheld in full or in part, regardless of any expenses incurred by Tenant, regardless of the financial status of the premises, or the legality of the premises. Rent must be paid to Owner or Owner's agent only. Non-payment or payment to any other party is a violation of this Lease Agreement and cause for immediate eviction.

Existing tenants need to be aware of this fact and should not be allowed to see the owner's financial status as an opportunity for Free Rent. It is a good way for them to ruin their credit and be evicted. The banks also can take quite a while to evict an existing tenant after a foreclosure. In many cases they'd prefer the tenants to stay until the home is sold. During all or part of that time, the tenant has the opportunity to benefit from low or no rent, which will make up financially for the inconvenience of the foreclosure.

Copyright © 2009 - 2014 The Landlord Protection Agency, Inc. All Rights Reserved.Would you like to re-print this article on your website or publication?

Permission is granted to use this Landlord Protection Agency article upon the following terms:

- Full credit for the article is given to the author and The Landlord Protection Agency, www.theLPA.com

- You display a link on your website to The Landlord Protection Agency. (www.theLPA.com).

The house we rent is in foreclosure - rent ? - Landlord Forum thread by Anne (Arkansas)

Sunday, June 22, 2014

6 Ways to Turn Good Tenants into Better Tenants

Retaining Good Tenants Means Starting Off on the Right Foot!

We already know that the key to a successful tenancy is to first find a good tenant. Haven't we often secured good tenants only to find they drift to the wayside and gradually become bad tenants? Why is that? There are a combination of reasons that this happens. Those reasons are what I refer to in The LPA's article, "The 6 Biggest Landlord Traps". Let's explore how to make good tenants even better and how to keep them that way.

Now that you have a good tenant you have already screened, accepted and signed a lease with, you may be tempted to feel like your job is finished for now. The property is rented! Now you can take a vacation, right? Wrong. The job is never over unless you sell your rental property and retire somewhere nice, never to see or speak to another tenant again. Are you going to do that anytime soon? OK, so lets talk about making good tenants even better.

- Emphasize the most important lease clauses.

If you haven't already done so when you carefully went over the lease personally and emphasized the important items to your tenant, do it as soon as possible. (I hope you used my LPA Lease - I'm personally biased.) You can even do it with a follow up letter welcoming the tenants to their new home an reminding them of those key elements in your lease that are most important to you. Some landlords even send the tenant a spare copy of the lease with certain clauses highlighted.

- Tell the tenants that you report to "National Tenant and Credit Reporting Bureaus". The reason I phrased it like that is because I don't want you to feel like you may be telling a lie. Reporting to a "National Tenant and and Credit Bureau" could mean the LPA's "National Tenant Rating Bureau or Deadbeat Database"". Or it could also mean that you are ready to use The LPA site to "prepare a delinquency report" to the major credit bureaus. I have achieved outstanding results by advising new tenants not to pay late because it can affect their credit rating. I inform them that they may not qualify for a car loan or mortgage in the future if they are not careful about their rent payment. I warn, "PLEASE DON'T RENT FROM ME if you think you will have trouble paying the rent on time. You seem like such a nice couple. I'd truly HATE to ruin your credit and damage your financial future". By the way, The LPA has a free members only tenant credit reporting feature that may help you collect delinquent rents.

- Enforce your lease with "Essential Landlord Forms" that will support your lease. When a tenant gets out of line, correct the situation with a professional form. Nip the problem in the bud before a small problem becomes a disaster. If you do not send a late notice as soon as the rent is late, the tenant will continue to be late. If you are inconsistent with sending the late notice, the rent may consistently be late. Have you ever heard the old adage "Familiarity breeds contempt" ? Well, when a tenant becomes comfortable enough to think the landlord is a friend, he often loses the professional respect he may have once had. So, enforcing the lease with professional forms is the way to go.

- Enforce penalties such as late fees. Using a professional form is great, but it has to pack a punch to get the results you want. Don't be afraid to hit a tenant with the late charge whenever the rent is late. I've had tenants tell me they were late just to see if the late fee would be enforced! Use a "Late Charge Due Notice" or an "Urgent Late Notice" to collect rent and late fees before too much time passes by.

- Allowing an Early Payment Discount is another effective tactic to get the rent paid on time or early. Everyone wants to save money. And that money adds up over the year, so make sure the tenants know about it. If you didn't use the clause in your lease, you can always send them the "Early Payment Discount Voucher" found in Essential Forms.

- Routine Inspections aren't always as important as the expectation of routine interior inspections. When the tenant is expecting an inspection of the premises by the landlord or manager, the property is usually kept ready to pass the inspection. Many landlords will inspect on regular intervals prearranged with the tenant. Others will do surprise inspections, and some just emphasize that they will be doing inspections, but just don't get around to it. Even if you can't get around to it, it may be a good idea to send the tenant a note from time to time to tell them of an upcoming inspection. The main thing is that your property is cared for properly.

Keeping good tenants good or better is an ongoing process that we as landlords continue to improve with experience. It all starts with understanding and agreeing with each other. After that, it's just a matter of professional communication.

Picky Tenants with Allergies - Landlord Forum thread

I apologize in advance for the length of my question/story! We have a 75 year old log cabin that we bought and completely renovated, (paint, new kitchen, log repair/replacement, new wood floor, tile in bath and kitchen, fixtures, doors, some new windows etc.) and turned into a rental 2.5 years ago. When we bought it there was new hvac and ductwork that had been installed within a year. We rented the house for 2 years and first tenants moved out in April. They were very happy, no issues other than squirrel in attic and needing a new thermostat for hvac. They did some pet damage to the house and left some stuff dirty but overall typical tenant damage. Rented to new tenants in May and complaints started immediately, said it wasn't properly cleaned (I cleaned it myself really well), then several days later they reported mice living in the stove, we immediately had an exterminator out and had a handyman block some holes the exterminator had found. We also replaced the stove, it was the only appliance not replaced in the renovation. Several days later our property manager sends us a 3 page email detailing all of their issues with the house. It was never mentioned before but apparently both tenants have severe allergies. Complaints include, dirty duct work with possible mold, oily dirty steam drips in the microwave, dog hair everywhere, slow draining sink in bathroom, mice feces oozing out of the tub enclosure, dirty ducts, meat cooking odor in the kitchen,just to name a few. According to them there allergies are unbearable and they can't run the hvac. I just want to point out, this is a really nice house, newly renovated, tons of curb appeal, the microwave was only 2 years old, hvac/ductwork less than 5, great location, great yard. My husband and I arranged for a trusted hvac person to come over and look at/perform maintenance on the system. We also took a look at all of their concerns. It was obvious that the previous tenants had run the hvac for quite some time with no filter, also they ruined the brand new 2 year old microwave, vent hood unit with something they cooked frequently,greasy steam did actually drip out. The tub was fine. We addressed each of their items and left telling them we would get back with them the next day with a plan.

The next day we bought a new microwave, and arranged for duct cleaning from a reputable company our hvac guy recommended. The woman flipped out and got really aggressive about wanting " a licensed mold abatement company." Anyway we have been going back and forth, we offer something, it's not good enough, or they say their too busy to be there. They keep escalating what they want.

We finally offered to let them out of their lease, I assumed that's what they were gunning for anyway. They came back and said they were insulted that we had suggested that. I'm at a loss, we've offered to spend $450 to get the ducts cleaned and if they want something beyond that they need to pay.

What should we do? I'm exhausted and frustrated and wish they would move out. I don't think they'll ever be happy but I just want to make sure we're doing what we need to do legally. Based on everything I've read we've gone above and beyond. We're kind of laying down the gauntlet because their demands are getting out of hand.

Regarding allergy complaints, previous tenants had a dog and it was no secret, we advertise that we will consider pets for all our rentals. Our property manager said the tenant had gone through this issue with allergies at a previous house so my feeling is that they should have done better due diligence. A 75 year old log cabin that has had pets in it for years is probably not an ideal choice for an allergy sufferer.

We have a property manager but she hasn't been a huge help, I think she's worried they're going to do something crazy, they have talked a lot about "documenting their medical bills for allergies" etc.

Anyone been through this situation before? We have a picky tenant at another of our rentals but when we offered to let them out of the lease "if they weren't happy" their complaints dried up pretty quickly. No such luck this time!

Saturday, June 21, 2014

The Secret Career Killer Facing Landlords

Are you a "Buy & Hold" real estate investor?

By John Nuzzolese So, you want to be a real estate investor? You are probably thinking the way I did when I started as a real estate investor. I thought the most important objective was to buy as many properties as possible. Well, I was only half right.

So, you want to be a real estate investor? You are probably thinking the way I did when I started as a real estate investor. I thought the most important objective was to buy as many properties as possible. Well, I was only half right.

As an investor in residential real estate, being able to purchase properties that will allow you to make money is paramount. While there are various methods you can use to make your real estate fortune, the two most common plans are quite simple.

Buy and flip. This is when you purchase a property and sell it for a higher price. Many investors will find "Handyman Specials" or "Fixer Uppers" at a low price to improve and sell at a higher price. Sometimes you are fortunate enough to find an excellent opportunity requiring little or no work, only to resell for a quick and easy profit. Although this is a common way to make money in real estate, many investors choose not to sell their investment property.

Buy and hold. This is when the real estate investor becomes a landlord in order to enable the investment property to generate income. Holding onto the property is also a way to allow the investment to appreciate in value over time. Why? The demand for residential real estate continues to grow and people are willing to pay top dollar for a place to live. What can be better than that? You have an asset appreciating in value plus you also have a tenant to pay your expenses on the property. You may even have a positive cash flow.

So what is "The Secret Career Killer Facing Real Estate Investors"? Before I answer that question, let me ask you,

- What happens when you put investment properties together with tenants?

- You get a landlord tenant relationship. I wish I realized the ramifications earlier.

Tenant problems are the one of the biggest reasons, if not, the biggest reason most landlords quit investing in real estate and sell their rental properties way before benefiting from one of the best features of owning real estate: appreciation.

It is just as important to learn the secrets of landlord protection and property management as it is to know how to accumulate rental property. Let me say it another way: Without knowledge of landlord protection, you as a landlord, are in big trouble!

Think about how much money people spend on books, seminars and trial and error learning about buying real estate. It’s incredible! I invested so much money learning creative ways to buy property. How about you? How much have you invested learning to be an efficient landlord? Most landlords learn their lessons the hard way like I did. Fortunately, now there are some books and websites on landlord topics that can shed some light on the subject and allow average landlords and “Newbies” to become educated and aware of their legal rights concerning landlord – tenant relationships.

What good is struggling and sacrificing to own a lot of properties only to bail out because of overwhelming tenant problems?

Get educated in the art of “landlord protection”. Learn how to avoid tenant problems so you can keep buying more investment property.

The three most important landlord issues to learn about for your own protection are:

- Screening and Tenant Selection

- I always say, "95% of tenant problems can be eliminated in the screening process!" It really is so true. A lot goes into screening a tenant properly, so try not to jump into any lease agreements without doing your homework first. The article, How to Screen Tenants in 5 Easy Steps will help you break down what to do when it comes to screening your potential tenants. The idea is to make the screening process as simple as possible for you while helping you to eliminate the unqualified prospects and focus on the more promising ones.

- Using a solid landlord lease

- One of the keys to a good landlord – tenant relationship is having both parties involved come to an understanding and agree with the terms in the rental contract. All too often we hear of and see tenant problems that could have been avoided if only the parties had used a better lease agreement. The problems usually stem from an issue that the lease should have covered, but did not. Most of the traditional leases are designed to make both parties happy, especially the tenants. Conventional leases are politically correct not to offend tenants and often leave the landlord wide open and prone to problems with the tenancy. Unless the landlord takes steps to protect himself in his lease agreement, the law will offer the tenants a strong bundle of rights giving them a legal advantage.

- Lease Enforcement

- Even with the greatest lease agreement in the world, a landlord faces a myriad of potential tenant problems. Enforcing the lease has to start the moment you sit down with the tenant at the lease signing. I know you may still be in the negotiating stage on certain items concerned in the lease, but enforcing the lease begins here. Reading the entire lease, clause by clause, emphasizing topics that are important to you reinforces your terms from that point on. Later on, when lease infractions occur, you must be prepared to jump on the issues professionally and immediately. Having the proper landlord forms to enforce your lease is essential. Using forms to correct tenant problems is both professional and efficient because you are creating an official record on paper of your legal communications concerning the events at hand. From an Urgent Late Notice to a more serious Eviction Notice served properly on a tenant, the landlord projects a far more professional image. The objective of the lease enforcement forms is to squash small tenant problems quickly and professionally before they develop into full blown disasters, while snapping the tenant back in compliance with your lease agreement.

If you have experienced the unpleasant part of being a landlord which includes loss of rent, possible foreclosure, loss of sleep, confrontations with unreasonable tenants, expensive repairs and restoration, vandalism, theft, squatters, evictions, legal fees, you may have had to consider if it's all worth it or not. Many new new investor / landlords decide quit the landlording business soon after a bad tenant experience.

As a real estate investor who intends to be a landlord and enjoy that excellent long term appreciation, it is absolutely imperative to have some landlording knowledge. I strongly recommend having more landlord tenant knowledge than your tenants do!

Happy investing and landlording!

About the author:

As a Real Estate broker / investor in New York, John Nuzzolese has been involved with rentals and investment property since 1979. Besides owning and operating two real estate businesses, he is president and founder of The Landlord Protection Agency, Inc. , an organization specializing in helping landlords and property managers avoid the hurdles and pitfalls and expensive blunders common when dealing with tenants.

More information on The Landlord Protection Agency is available at www.theLPA.com

Copyright © 2000 - 2014 The Landlord Protection Agency, Inc. All Rights Reserved.

Tuesday, June 17, 2014

The Top 5 Ways to Ruin a Good Tenancy

5 common ways landlords ruin perfectly good tenancies

Imagine having the perfect tenants in your rental property. Maybe you already have them now. What we really hope is that these perfect tenants will remain perfect. To continue doing all the right things and not doing any of the wrong things. We want them to obey the lease agreement religiously, take care of the property and pay the rent on time or early. Imagine a tenant who leaves the rental better than it was found. Is this idea from the The Twilight Zone or something you can really have?

Most of the time, when we actually have a tenant that seems "too good to be true", something happens either suddenly or gradually to turn our tenant to the dark side.

Here are 5 common ways landlords ruin perfectly good tenancies:

- Are They Friends or Tenants? Failure to maintain a professional distance from the tenants. Too often a landlord will fall victim to one of the oldest Landlord Traps by lowering his guard and allowing the tenants become personal friends. Rarely does this end well.

- Broken Promises Failure to fulfill certain promises made to the tenants in the beginning of the relationship is a leading cause of the breakdown of the tenant's trust and respect in the landlord.

- Greed In the real estate business for many years, I have found one thing to be universally common among sellers and novice (and many pro) landlords. It is the belief that their property is somehow better or worth more money than comparable listings that have sold or rented. It is this squeezing every dime out of a property that causes the tenant to resent the landlord. Even a good tenant can not help but dislike a greedy landlord who is overcharging the tenant. Overcharging? How can anyone say it's overcharging if the tenant agrees to the price?? There are many reasons a person will agree to pay a higher amount.

- tight rental market

- family crisis

- tenant not qualified for another rental

- many other reasons

- Neglect Being a landlord is a business. For a business to do well, it must be maintained and run properly. That includes caring for rental property. As much as we try, we can't always make the tenants responsible for everything on a property. Some responsibilities belong to the landlord. It is important to nip small problems in the bud before they become major catastrophes. Besides, if you keep the tenant satisfied, your property will be more rent-able/sale-able.

- Conduct Unprofessional conduct can range from rudeness to overly friendly. Try to refrain from arguing, using profanity or gossiping with tenants. It will come back and bite you. Let your attorney be the bad guy. He's the guy who tells you to "enforce your lease". Keep a professional, polite attitude to retain the respect of your tenants. Tenants respond better to a pro who knows what he or she is doing.

Monday, June 16, 2014

Early Occupancy - Allowing Tenants In Before the Lease Starts

"Can we have the keys a few days early?"

Early Occupancy Agreement Lease Addendum

How often do your new tenants ask if they can have the keys a few days before the lease begins?

Many landlords are only too happy to start off on a good note with their new tenants and gladly grant them early possession.

But wait! Are you getting paid for those days? Many landlords don't even think about what those free days are worth. (If you prorate the monthly rent by dividing the rent by 30 days, you'll get the daily amount per day) -

On the other hand, the tenants may be doing you a favor by taking the property "a few days early" by getting the utilities into their name instead of yours.

More importantly, many landlords don't even realize the ramifications liability-wise when the they allow tenants to pre-occupy the rental before the lease begins.

More importantly, many landlords don't even realize the ramifications liability-wise when the they allow tenants to pre-occupy the rental before the lease begins.

Think about it.

What rights do tenants have when they occupy your rental, with the key you gave them, before the lease begins? They have all the legal tenant rights they can possibly have, without even being bound by the rules in the lease that hasn't even started yet. Do you think tenants might use this time to try to re-negotiate the lease or demand certain things be done before the lease term starts? You bet! They think they've got you over a barrel - and they may!

The Early Occupancy Addendum (EOA) protects the landlord when tenants move in early.

Thursday, June 5, 2014

Rent Payment: Cash, Check, Money Order, Pay Pal...

Collecting the Rent: What Form of Payment Should You Accept?

By John NuzzoleseIn today’s changing times, technology plays a larger role in the way we do business. More options are available to us in banking, communication and in collecting the rent from tenants.

Just as every property is unique, so is every landlord and his business. How landlords and property managers choose to collect rent varies greatly depending on experience and circumstances. There are a number of payment methods available for you to choose from when it comes to collecting rent from your tenants.

You can accept your rent:

In Cash

Accepting rent payments in cash normally means personal contact with the tenant, which can be quite involved at times. You may be thinking, “Cash is the simplest form of payment”, but in reality it can be a royal pain in the neck! Think about the pros and cons and you decide.

The Pros of collecting rent in cash

The Cons of collecting rent in cash

You can accept your rent:

By Check

The Pros of collecting rent by check

Tip: Professional landlords have tenant mail the rent to a PO box or a management office, not their home.

The Cons of collecting rent by check

Checks bounce when the tenant doesn’t have the money in the bank

Checks bounce when the tenant doesn’t have the money in the bank

Accepting your rent by Money Order

The Pros of collecting rent by Money OrderThe Cons of collecting rent by Money Order

Electronic Rent Collection: Direct Deposit

More and more landlords are making the arrangements with their banks (with their tenants’ cooperation) to automatically withdraw a monthly sum from the tenant’s bank account to be transferred into the landlord’s bank account on a set day every month. This can be an effortless method of rent collection as long as the tenant has the required money in the bank at the time of the transfer. It is an even better situation for the landlord when the tenant is qualified for sufficient overdraft protection.The Pros of collecting rent by Automatic Withdrawal

The Cons of collecting by Automatic Withdrawal

Electronic Rent Collection: Credit and Debit Cards

Many property management companies and even private landlords are accepting the payment of rent by credit and debit cards. Access to this is normally restricted to businesses with merchant accounts to be allowed to accept the major credit cards, but now in today’s high-tech environment, just about anyone can have a PayPal account to enable them to accept credit card payment.The Pros of collecting rent by Credit and Debit Cards

The Cons of collecting by Credit and Debit Cards

Copyright © 2009 - 2014 The Landlord Protection Agency, Inc. All Rights Reserved.Would you like to re-print this article on your website or publication?

Permission is granted to use this Landlord Protection Agency article upon the following terms:

- Full credit for the article is given to the author and The Landlord Protection Agency, www.theLPA.com

- You display a link on your website to The Landlord Protection Agency. (www.theLPA.com).

Wednesday, June 4, 2014

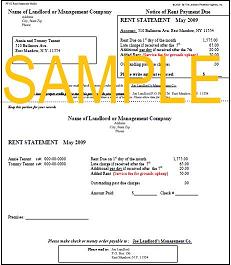

Another Way of Helping Tenants Pay Rent on Schedule

Fact:

Rent is Paid More Timely When the Tenant Receives a Monthly Rent Statement

Whether you mail your tenant a monthly statement the same way your bank mails you your credit card statement, or supply your tenants with a Payment Book with pre-printed payments slips, the results are the same. The tenants are reminded of what they owe, when it is due, and what the penalties are for not paying on time.

Most landlords have positive results and more timely payments when using a Rent Statement mailer. It helps tenants Want to pay their rent on time and preserve their credit record with their landlord.

The Rent Statement displays the key monetary terms agreed in their lease. That's important because the tenant is reminded of these key items every month when they fill in the amount of their payment before sending it.

Tenants find it a little intimidating and a little more official when their Social Security # is on a document. This part is optional and need only be included at your discretion.

On the top right below the rental address is a payment breakdown area which includes:

On the top right below the rental address is a payment breakdown area which includes:

- the rent due date

- the rent amount

- the late date and late fee

- the daily late date and daily late fee

- early payment discount date and amount of early payment discount (optional)

- Added rent incurred (any current or past due charges in addition to the rent)

The top tear off slip also includes the landlord's mailing address and instructs the tenant to whom to make the rent payable. Since it is editable in MS Word, it is also easily fitted for window envelopes with the tenant's address showing through.

The bottom portion has a place to record paid amounts and a check # and can be kept for the tenant's records.

When sending the Rent Statement Mailer, it is a good idea to enclose a pre-self-addressed envelope for the tenant to simply drop the top portion of the statement in along with the rent payment. Some landlords even prefer to stamp the envelope in an effort to remove every possible obstacle in the way of getting the rent paid. Personally, I say let the tenants buy their own stamps. If they are that helpless, we shouldn't have them as tenants!

(Sorry to sound so hardend, but after dealing with thousands of tenants over the years, you get this way! ;) )

Tuesday, June 3, 2014

The Move-Out Process

What do I do when the Tenant has Moved?

When a tenant has vacated a tenancy, you must handle the situation properly, especially if you want to avoid problems with your former tenant and the possibility of legal hassles and a big waste of time, aggravation and money.

Either the tenant has moved out:

If your tenant vacated your rental property properly in accordance with a conventional or LPA Lease agreement, it is likely that he left the property in acceptable condition. Meaning that it was returned to you in acceptable condition so you can then rent the property to a new tenant. It also means that the tenant has paid the rent throughout the term of the lease to the last day and is not owing the landlord any money.

Often there are charges against the security deposit, even when the tenant has done a great job complying with the Lease Agreement. You will probably minimize damage and clean-up by using the Move-out Reminder Letter and Move-out Cleanup & Debris Letter, but the tenant still may violate the lease and cause all kinds of damage.

Assuming the tenant left the premises in poor condition, the landlord is required to follow a certain procedure to keep or collect money from the tenant to cover damages. The Landlord Protection Agency makes it easier to do that with the use of various Essential Forms:

- Property Condition Report checklist : Documents & certifies the condition before and after the tenancy.

- Security Settlement Statement: Officially lists the charges made against the security deposit and also notifies the tenant of any additional charges above the amount of the security deposit.

- Settlement Charges Guide: A little something we like to give tenants along with their Security Settlement Statement just to show them how much we really should have been charging them for some of the usual damages.

- Security Settlement Challenge Crusher : This form is made to squash tenant's unfounded claims to security money back.

By having these forms in your computer, ready to roll if you need them, you won't miss a beat when the time comes for withholding security deposit money or charging the tenant for specific items.

Monday, June 2, 2014

Tenant Tricks to Recognize

A common excuse why the tenant was not able to pay the rent on time. Of course, being out of town on business all the time can make it impossible to mail the rent. What about mailing it early? What about automatic withdrawal? These things would solve the problem and would be used if the tenant was sincere... One tenant tried this on me when caller ID was a brand new feature. He said he was calling from out of state, but I saw his home phone number on the ID!

The Old "Please Don’t Call or Tell my Wife I’m Late with the Rent" Trick:

An attempt to get the landlord in on the conspiracy to save the marriage of the tenant. A big load of BULL.

The Old "You’re a great guy" Trick:

Another attempt to BS you. Sometimes the tenant will give you small gifts to demonstrate his goodwill while he bilks you for months worth of rent. The idea is to make you feel better while you are being taken advantage of. I had a tenant who delivered a pizza to my house. (I was afraid it might be poisoned because I was evicting him.)

The Old "Self Employed with fake income records" Trick:

Self employed tenants are among the most difficult references to verify. Why, because as their own boss, the tenant prospect is giving you his own references on himself. Is it possible he might exaggerate his success and income and create corresponding exaggerated reference material? You bet it is!

The Old "Threaten the Landlord with a Discrimination Suit" Trick:

A common tactic of a disgruntled rental reject. This trick works on many inexperienced landlords. Law abiding landlords who always follow proper tenant screening procedure should not fall victim to this.

Eviction Ramifications Notice

Eviction Ramifications Notice